BT 0100–AAIS BOATOWNERS SPECIAL COVERAGE FORM ANALYSIS

(July, 2018)

|

|

This article is a discussion of the (05 08) edition of the boatowners program offered by the American Association of Insurance Services (AAIS). It is structured in the same manner as its other lines of business, opening with a table of contents.

TABLE OF CONTENTS

This form’s table of contents consists of items appearing above in this article’s collapsible index.

Any endorsements and schedules that are part of the policy will be identified on the "declarations."

AGREEMENT

The agreement section states that the policy is subject to all its “terms” (see definition below) and it will provide the applicable coverages that are described in the policy. These coverages are provided for a specific policy period. In return for this protection, the insured must pay any required “premium.” In the agreement section, it states that a “limit” must be shown on the “declarations” for the principal coverages to apply.

DEFINITIONS

The definitions section appears in the beginning of the policy and it contains the following important terms.

1. “You” and “Your”

The person or persons named as the insured on the "declarations." That person’s resident spouse is also “you.” However, if that spouse ceases to be a resident, he or she is no longer considered “you.”

2. "We", "Us," And

"Our"

The company providing the boatowner insurance.

3. Actual Cash Value

The amount it takes to repair or replace property using comparable materials; but that amount includes consideration of depreciation.

|

|

Example: Kim and Joe both own nearly identical sailboats (Joe’s model is two years older) and are protected by a BT 0100 from the same insurance company. Both insured’s boats are destroyed during a storm that devastates their marina. Joe receives $3,200 less for his loss than Kim. The difference was due to a greater amount of depreciation for Joe’s boat. |

4. Boat

Refers to property designed to travel on water and includes sails, its permanent equipment, spars and fittings. Outboard motors are not considered boats.

5. Boating Equipment

A wide variety of property that is used in conjunction with boats is listed. Items considered as equipment are property used for communication (radios), navigation, sonar, radar, outboard motors, dinghies, along with water skis and sports equipment (recreational flotation devices) that are towed by boats. As a rule of thumb, the more related an item is to the ownership and use of a boat, the greater the justification to classify it as boating equipment.

6. Boat Trailers

Trailers designed for transporting boats. It remains a boat trailer even if it isn’t hauling a boat.

|

|

|

|

Boat trailer – YES |

Boat trailer - NO |

7. "Bodily Injury"

Actual or physical harm to a person. Harm includes sickness, disease, or death. Any required care and loss of services also qualifies as Bodily Injury (BI).

|

Example: An insured invites his old college friend to go fishing with him. While his friend gets up to get a beverage, he slips on some fishing line leads and slams face front on the boat’s deck. His broken wrist qualifies as bodily injury. |

|

This definition is not as broad as it may appear since it contains some important exceptions. The term does NOT apply to physical harm, sickness, disease, or death that is due to any of the following causes:

· Mental or emotional injury

· Suffering

· Distress

These conditions fail to qualify as BI only when they are not related to a person being tangibly harmed.

|

Example: An insured invites several friends to go fishing with him. While one friend gets up to check his line, his pants are snagged on a spar and are pulled off. He is ridiculed by everyone for the rest of the trip. While he is deeply embarrassed, this feeling does not qualify as bodily injury. |

8. "Business"

A trade, profession, or occupation. This term includes the operation of yacht clubs, shipyards and marinas. The policy also refers to boat sales, charters, rentals, repairs, services, storage, mooring and anchoring as examples of business activity.

This definition has an important exception. An insured who is entertaining a business client on covered property is not considered to be performing a business activity.

|

Example: Julie has invited Paula onto her boat, “Light Tymes,” for an evening meal and cruise. Paula is Julie’s Accounting Firm’s largest client. Paula falls while trying to get a closer look at a nearby yacht. The treatment for her injury should be eligible for coverage as her presence on “Light Tymes” is not considered a business activity. |

Note: The reason for the exception? Likely because the exposure to loss is not significantly different than having a non-business guest on a boat. This is the opposite of the approach used in homeowner policies where the mere status of a person being a business client may endanger coverage for a loss or injury.

9. "Covered Property"

This term refers to the relevant property that is described on the policy’s declarations, specifically boats, equipment and trailers. The term also applies to property referenced under the policy section on newly acquired property.

10. "Declarations"

This refers to any document that is called or titled Declarations, Supplemental Declarations, or coverage schedules that are related to the policy. A list of eligible property appearing on a document with descriptions and values would qualify as a declaration.

Related Article: Boatowners Declarations Page

11. “Insured"

The Boatowner policy considers all the following to be insureds (with notes on any exceptions):

a. The named insured and any resident spouse.

b. Relatives of the named insured and/or the resident spouse. However, relatives are insured only if residents of the named insured’s household.

(meaning relatives who live at the insured location with the named insured)

c. Persons under the age of 21 residing in the named insured’s household and in the named insured and/or resident spouse’s care or in the care of resident relatives as defined above.

Note: Such persons must BOTH be younger than 21 AND have a named insured, his or her spouse or a relative of the named insured/spouse as their caregiver.

d. Other entities are also insureds but only for under Coverage X and Y, Personal Liability and Medical Payments. These entities are:

1) Any person taking care of or using property that qualifies as covered property. However, the possession or use must be with the named insured’s and/or resident spouse’s permission.

2) Any person who can be held legally responsible for an insured’s, as defined in a. b. or c. above, use of covered property may also qualify as an insured; but only to the extent of loss directly involving covered property.

But the insured status granted in d.1) or d.2) does not apply if property use is business related.

.

|

Example: James has agreed to repair

Peter’s boat for $500. To determine if the repair is complete, James takes

the boat out for a spin. James hits another boat. Peter would be covered for

his liability (if any) but James would have no coverage because he was using

Peter’s boat for the business use of repairing it. |

e. The policy’s Uninsured Boater Section (Coverage Z) has a more limited definition of “insured.” Specifically, the only insureds under Coverage Z are:

1) Any person while on or in covered property or non-owned boats. This status is extended even when that person is either entering or exiting. Persons being towed by either covered property or “non-boats” are also insureds. However the insured status does NOT apply if the person is being towed on a device that is designed to fly.

2) A person who is in anyway entitled to receive Coverage A. damages because of injuries sustained by a person described in item e.1).The damages must involve bodily injury and are limited JUST for the extent of damages.

|

Example: Larry is towing Angel and

she is thoroughly enjoying her session of water-skiing….until Paul swoops

over and cuts her line. Angel is injured and sues Paul. Paul is uninsured.

Larry’s uninsured boater coverage will cover Angel’s injuries. In addition,

Angel’s mother is an insured because she incurs damages on Angel’s behalf. Angel’s

mother’s new, custom water-skis were demolished in the accident

but that loss is not covered because they are property damage, not bodily

injury. |

|

Of course, no matter how carefully a definition is worded, confusion may arise.

Related Court Case: “Confusion Over ‘An Insured’ Or ‘The Insured’"

12. "Limit"

The policy merely defines this as the amount of coverage that applies, the inference being the amount of insurance that appears on the declarations related to the boat policy (or, if applicable, given coverage part).

13. "Motor"

Refers to an outboard motor as well as certain equipment such as motor starter, controls, batteries, fuel tanks, pressure control tanks, harnesses and similar items.

14. "Non-owned Boat"

Any boat that is not owned by the named insured or resident spouse but is used by them, a resident relative or by persons under the age of 21 who reside in the named insured’s household and are in care of the named insured, resident spouse or other resident relatives. The term boat includes any trailer used with such property. However, a boat does not qualify if it exceeds 30 feet in length. Besides not owning such property, to be considered non-owned, it cannot be available for the regular use of an insured.

|

|

Example: Marnie just rammed into a

pier, mostly because she was surprised at the power in the custom outboard

motor attached to Joe’s boat. She swore she would never trade boats “just for

fun” again. Luckily, Joe’s boat qualifies as a non-owned one so Marnie has

coverage on her boatowners policy. |

15. "Occurrence"

An accident from which "bodily injury" or "property damage" results during the policy period. Repeated exposure to similar conditions is considered one occurrence.

|

Example: An

insured’s teenage son borrows his dad’s boat and, ignoring instructions, goes

roaring by several rowboaters and water-skiers. He gives them all serious

scares but doesn’t injure anyone. The scares do not qualify as occurrences

because there is no bodily injury or property damage. |

16. "Personal Watercraft"

Refers to equipment that moves via jets of water (waterjet propulsion). Besides the method of power, the equipment must also be designed for the operator to kneel or sit or stand in the craft. Wave runners and jet skis are examples of personal watercraft.

Related Court Case: "Jet Ski" Exclusion Held To Apply To A Variety Of Similar Watercraft

17. "Pollutants"

Any irritant or contaminant. It can be solid, liquid gaseous or radioactive. Acids, alkalis, chemicals, fumes, smoke, soot, vapor, and waste are examples of pollutants. Materials to be recycled, reclaimed, or reconditioned are considered waste, as well as materials that are being disposed of. All electrical or magnetic emissions either visible or invisible are considered pollution along with sound emissions.

18. "Property damage"

Destruction or merely physical injury of tangible property. It is also the loss of use of tangible property. There can be loss of use even when the tangible property is not physically damaged.

19. “Terms"

All provisions, limitations, exclusions, conditions, and definitions used in this policy or pertaining to it.

PROPERTY COVERAGES

PRINCIPAL PROPERTY COVERED

This policy provides coverage for boats, motors and trailers that appear in the declarations. The listed property must include a coverage limit and coverage applies according to the policy’s property definitions.

Note: Qualifying as eligible property is important.

A policy with a declarations that, through some error, listed an amphibious craft would run into a coverage problem, despite its appearance on the declarations.

|

Example: Yarty had a boat policy that included the following: |

||

|

Property |

Limit |

Premium |

|

Sunsmyler 24 ft. Sailboat |

$7,800 |

$129 |

|

Waveslug, 18 ft. trailer |

$2,900 |

$46 |

|

2009 WaterPlus 4200XL |

$27,000 |

$490 |

|

The WaterPlus is destroyed in an accident. When investigating the loss, it’s discovered that the craft was destroyed in a collision at a marina’s parking lot. The loss is denied since it was an amphibious craft. The insurer also refunds the premiums Yarty paid for coverage. |

||

PROPERTY NOT COVERED

1. Business

The boatowner policy does not insure boats, motors, equipment or trailers when the property is used in business activity including the chartering of such property, renting it out to others and if used to move either property or persons (when paid to do so).

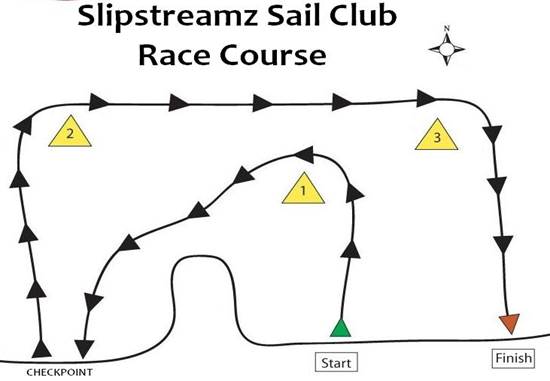

2. Racing and Stunt Activity

There is NO coverage for boats, motors, equipment or trailers when used in either races or stunt activity. The exclusion applies to either organized or spontaneous events and extends to preparing or practicing for such activities. “Racing” refers to competitions against other parties as well as against the clock.

|

Example: Jim

and Nora were headed back from their favorite areas to the docks after a long

day of fishing. They spot each other and the docks at the same time. Nora

shouts “last one to the dock cooks dinner!” They both rev up their engines

and rush off! If a loss occurs, it would not be eligible for coverage. |

|

One exception exists for sailboats. Sailboat races of any type still qualify for coverage.

3. Residential Use

Boatowner coverage does not apply to losses that take place when covered property is used as a residence (except for temporary use).

|

Example: Lanndy was entertaining some friends for dinner. One

friend slipped while getting a drink from the boat’s galley and slammed against

the galley’s sink and floor. Lanndy sent in a claim and it was rejected when

the insurer discovered Lanndy lives on the boat full-time. |

|

ADDITIONAL PROPERTY COVERAGES

The boat policy states that whatever limit shows in this section is the ONLY limit that applies to the referenced coverage. It is not in addition to the Principal Property Covered limit.

1. Boating Equipment

Such equipment (as defined under the policy) has a maximum amount of $2,500 available for addressing tangible loss or destruction. However, when such property is lost or destroyed while being used with personal watercraft, the maximum amount of coverage is $500. The $2,500 limit can be increased on the declarations.

2. Newly Acquired Policy

The boat policy will cover newly purchased or otherwise acquired property. All motors and trailers are eligible, but boats are covered ONLY when they are no longer than 30 feet. Coverage only applies for a maximum of 30 days after the property is acquired. Coverage under this provision can end earlier than 30 days. The first case is if the policy expires prior to the 30 days and the second is when the property is reported to the insurer prior to the 30 days. Premium must be paid for the new property effective from the date the property comes into the insured’s possession and is subject to a maximum of $25,000. It is likely that the modest maximum coverage is meant to encourage property being reported (then rated and charged) as soon as possible. The modest coverage could be a disaster.

|

Example: Kanera’s boat and property is covered by a boatowner

policy when she gets a new, much more powerful boat as a retirement present.

She received the boat on May 8th and, on May 19th (before

she had the chance to report its acquisition), the boat was stolen. She

reports the loss and her insurer sends her a check for $25,000. Unfortunately the boat’s purchase price was $65,750. |

3. Emergency Service

Under this additional coverage, the expenses related to towing and repairing a non-functioning boat or motor is covered. However this addition’s available payment does not extend to delivering fuel or oil, parts or supplies or for the cost of changing a tire (on a boat trailer). Further, the coverage only handles labor cost that is incurred at the location where the covered property is disabled and the maximum available coverage is $500.

Note: This valuable coverage is not subject to a deductible.

COVERED LOSSES

The boat policy states that it will respond to tangible loss to all property that qualifies for coverage under the policy and that any coverage depends upon the limitations and exclusions included in the policy.

EXCLUSIONS THAT APPLY TO PROPERTY COVERAGES

This boat policy section refers to a dozen situations that do not qualify for coverage. If any of the listed situations do cause a loss to boats, motors, boat equipment or boat trailers, even if created indirectly, the damage or loss is excluded.

1. Animal and Marine Life

No coverage is available when a loss involves animals or marine life. Examples included in the policy are birds, insects, rodentia, and any animals owned or in the possession of any insured.

|

Example: Jeremy

is furiously battling a swordfish during a weekend fishing trip. Just as he

is hauling the magnificent specimen onto his boat, it flashes around

violently gashing the hull. The hull damage is not eligible for coverage. |

|

2. Bubbling and Delamination

Plywood or fiberglass that experiences bubbling (trapped air pockets) or delamination (where layers of glued material separate) is not eligible for coverage. This situation is treated as a design defect or inherent flaw; so is not insurable.

|

Example: Brendan turned in a claim on his 4-year-old sailboat. He noticed damage to his stern’s hull. His insurer, reviewing the detailed set of photos he sent in with his claim, responded that the hull was showing advanced delamination and the loss was not covered by his policy. |

|

3. Civil Authority

Except for the acts of civil authorities to control the spreading of a fire, such acts that cause loss to covered property are ineligible for coverage. Property that is seized, placed under quarantine, damaged or lost because of illegal operations, is confiscated or destroyed are all examples of incidents that fail to qualify for protection under the boat policy.

4. Contamination or Deterioration

Boat policies are intended to handle fortuitous loss or damage to covered property. Therefore, loss or damage that takes place merely due to aging and exposure to water and boating environs are not eligible for coverage. Contamination to covered property due to bacteria, fungi and rotting is excluded, as is damage or loss due to weathering corrosion, decay and rusting. Any structural feature in covered property, such as a fault, weakness or quality that results in damage or loss is also excluded.

|

|

Example: Nancy

files a claim after a guest jumps onto her boat and part of the deck caves

in. The loss is denied when the insurer’s investigation reveals that the

deck’s wood had not been properly sealed and it

rotted out. |

5. Criminal Acts

Involvement in illegal activities that end up damaging or destroying covered property is excluded. Transporting illegal cargo or passengers are two examples of excluded illegal activities.

6. Freezing or Overheating

There is no coverage for damage to covered property caused by freezing or overheating. Thawing and sudden temperature changes are examples of the type of losses that are ineligible for coverage.

7. Intentional Acts

The policy does not cover intentional acts of any "insured" that result in a loss. The exclusion extends to losses resulting from intentional acts committed by persons acting on the directions of any insured as well as those performed in concert with any insured.

|

Example: Abner

is out fishing at his favorite spot on a lake near his home. Just as he hooks

a large bass, another boater, towing a skier, zooms by, breaking his line.

Later, Abner spots the offending boater and he rams him, severely damaging

both boats. The incident is NOT covered. |

|

The exclusion also is written to deny coverage that benefits an “innocent insured.”

8. Maintenance and Repairs

Loss or damage to covered property that involves the routine care and maintenance of such property does not qualify for coverage. There is an exception. If such activity, somehow, causes a fire or explosion, the subsequent damage or loss IS eligible.

|

|

Example: Chuck

recently reported a loss to his insurer. He lost one of his outboard motors.

He was cleaning it a couple days earlier and, as he got up to take a lunch

break, a pair of pliers fell from his pocket. Sparks were created when they

hit the floor, igniting droplets of gas that led to the motor. It was quickly

covered by flame. This loss is eligible for coverage. |

9. Mechanical Breakdown

Though ensuing loss or damage receives the protection of the boatowner policy, direct loss involving either mechanical or electrical malfunction or failure of covered property does not.

10. Nuclear Hazard

Except for direct loss by fire, the policy excludes any damage involving a nuclear hazard. This exclusion is unaffected by whether such loss was uncontrollable or accidental. Any smoke, fire or explosion loss or damage involving nuclear activity is still excluded.

11. War or Military Action

War is an absolute exclusion. Any loss connected to any war or war-like act is not covered. The exclusion does not even include damage caused by property that is seized or used for a military purpose.

12. Wear and Tear

There is no coverage for wear and tear, marring, or scratching.

|

Example:

Bronson is distraught when his outboard motor suddenly breaks off his boat.

He turns in a claim and the insurer inspects the

damage. Bronson is dejected when the claim is denied. The area of the boat to

which the motor was attached merely weakened with age and could no longer

support the motor’s weight. |

|

LIABILITY COVERAGES

PRINCIPAL LIABILITY COVERAGES

1. Coverage X – Personal Liability

a. Coverage

The policy obligates the insurer to pay for BI or PD that is caused by an occurrence (as defined by the policy). Any payment is subject to the policy’s applicable coverage limit. Any loss must be directly connected to either the use or other incidences of owning the covered property (which includes non-owned boats – again as defined).

|

Example: Jenna

was having a lot of fun operating her jet skis on the lake. The fun came to

an end when she cut across a skier’s tow line and the skier was seriously

injured. Jenna’s boatowner’s policy will respond to the skier’s lawsuit since

the jet ski was listed on her boatowner policy’s declarations. |

b. Defense or Settlement of Suit

This portion of Coverage X explains that the insurer will handle payment and/or provide a legal defense of an insured with regard to bodily injury or property damage that qualifies for coverage under the boat policy. Any legal defense costs are paid by the insurance company and the insurer has the right to select legal representation. However, as is the case with other lines of business, the legal obligation to defend against a claim ends once a loss settlement or judgment has been paid.

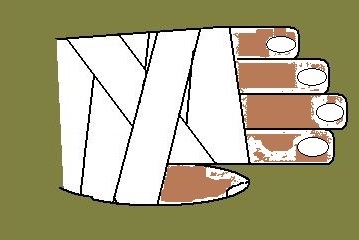

2. Coverage Y – Medical Payments

Besides stating the insurance company’s obligation to pay for certain costs that are connected to bodily injury related to the insured’s incidents of covered property ownership or use (regarding a non-owned boat too), it also lists the expenses that are eligible for medical payment. Eligible items include medical care, surgery, scanning processes, dental care, emergency transportation, first aid, hospital care, professional nursing, funeral services, prosthetics, hearing aides, eyeglasses (contact lens), and drug prescriptions. HOWEVER, the policy also states that it will only pay reasonable and incurred expenses. The expenses must occur within three years of the incident that created the injury.

ADDITIONAL LIABILITY

COVERAGES

The policy includes two more liability coverages. They must comply with all the applicable policy provisions that appear under principal coverages X—Personal Liability and Y—Medical Payments.

1. Claims and Defense Cost

In a defense action, the insurance company will pay the following:

· Costs that are taxed to an "insured"

· Costs incurred by the insurance company

· Premium on bonds that are required because of a defended suit. Only the premium for the amount up to the policy limit is covered. The insured must pay the premium for amounts in excess of the policy limit. The insurance company is not required to furnish the bonds

· An insured’s lost earnings caused by insurer requests that time be spent away from work (subject to a $250 daily maximum)

· Necessary costs incurred by the “insured” at the request of the insurance company

· Prejudgment interest that applies to the amount the insurance company pays, but the obligation to pay interest does not apply to the amount that accrues after the insurer makes a settlement offer

· Interest that accrues on the entire amount of a judgment. This item ends once the insurer pays or deposits its part of the judgement

2. Removal of Wrecked or Sunken Property

a. Under this portion of the policy, the insurer is responsible for the expense to retrieve (even from underwater), remove and/or destroy covered property (which includes owned boats, equipment and non-owned boats) that has been stranded, has sunk or has been damaged by fire. This obligation applies when the actions are required by authorities. The insurer is also obligated to pay such expenses even if the retrieval is unsuccessful.

b. This provision has a separate limit equal to a maximum of 25% of the total limit that applies to the affected, covered property.

|

Example: If

covered property has a total applicable limit of $10,000, the

removal/wrecked/sunken property limit is $2,500. |

EXCLUSIONS THAT APPLY

TO COVERAGE X – PERSONAL LIABILITY AND COVERAGE Y – MEDICAL PAYMENTS

Here are the sources of loss that do not qualify for coverage when they create loss or damage:

1. Abuse

Insurance policies, whether they cover boats, cars, homes or planes, are designed for accidental, not deliberate loss. In this vein, the boat policy excludes loss or damage that is due to any type of abuse. Examples are sexual molestation (including allegations), corporal punishment and abuse (both physical and mental).

|

Example: Gerald

is sued for an incident that occurred on his boat that is insured under a

boatowners policy. The lawsuit seeks damages of $30,000. It was filed by a

female guest who, when she attempted to leave after having dinner on board,

Gerald forcibly held her in his boat’s cabin for hours to persuade her into

intimate relations. The guest was also bruised from rough handling. Gerald’s

insurer denies the claim. |

2. Business Pursuits

Bodily Injury or property damage, whether it involves property owned by an insured or a nonowned boat, that occurs while it is being used in a business activity, does not quality for coverage. Business activity includes renting such property, using it for charters or using the property to move persons or property on a paid basis.

Note: Remember the business definition’s key exception. An insured who is entertaining a business client on covered property is not considered to be performing a business activity.

3. Communicable Diseases

BI and PD that are created by any form of communicable disease fail to qualify for coverage under the boat policy.

4. Controlled Substances

A portion of Federal Food and Drug law defines a number of substances as “controlled.” The boatowner policy specifically denies coverage for either BI or PD that is related to an insured’s use, sale, transporting, or possession of any such substance (primarily consisting of illegal narcotics and marijuana). The exclusion has a single exception. It does not apply to BI or PD that involves drugs that are legitimately prescribed and properly used.

Related Court Case: Overdose Injury to Guest Not Covered

5. Criminal Acts

Involvement in illegal activities that end up injuring others or that result in damage to property that belong to other persons is excluded. Example of excluded acts are those relating to transporting illegal cargo or passengers.

6. Intentional Acts

The policy does not cover intentional acts of any "insured" that result in a loss. The exclusion extends to losses resulting from intentional acts committed by persons acting on the directions of any insured as well as those performed in concert with any insured.

Note: The exclusion remains valid even when a loss may be different than what an insured meant to cause.

|

|

|

This exclusion does make an exception by still allowing coverage for injury or loss related to an insured’s act of self-defense or the defense of other persons or their property.

7. Land Transportation

The boatowner policy does not provide coverage for injury or damage when covered property is transported across land by either a vehicle or a trailer. In such instances, coverage is typically handled as an extension of any available vehicle coverage.

8. Non-Permissive Users

A loss that involves the use of covered property including qualified non-owned boats, is not insured when that property was used by a person who did not have an insured’s permission.

Note: This is an exclusion that can definitely be affected by circumstances as well as state law.

|

Example: Larry

borrowed his friend’s new boat because it is a model that he is thinking of

as a replacement for his current boat that is nearly 15 years old. Unknown to

Larry, his visiting, 16-year-old nephew takes the boat out for a joy

ride….and he crashes into another boat. This loss is not covered under

Larry’s policy. |

|

Note: This exclusion does not make reference to the age of a person using insured property without permission. It is likely that the exclusion could be successfully challenged if a legal minority were involved.

Related Court Case: Boat Owner's Liability Insurance Held Primary Over Permissive Operator's Homeowners Insurance

9. Nuclear Energy

Accidental "bodily injury" or "property damage" is excluded when it involves an "insured" that is protected as a covered person under a nuclear energy liability policy. The exclusion applies even if the status of a covered person under a nuclear energy liability policy is lost because of exhausted policy limits. The boatowner policy defines a nuclear energy liability policy as one that is issued by one of the following insurers (INCLUDING SUCCESSOR COMPANIES).

- American Nuclear Insurers

- Mutual Atomic Energy Liability Underwriters

- Nuclear Insurance Association of Canada

10. Parasailing or Kite Skiing

It does not matter whether the towing craft is owned or non-owned by an insured, there is NO coverage for incidents involving kites, parasails, hang gliders or similar devices.

|

Example: Paula

loves boating and she often invites friends along

for water fun. She turned in a claim for a loss that occurred during an

excursion. She had borrowed a friend’s parasail and had, for several hours,

been towing friends with her boat. During one tow, Paula abruptly slowed her

boat to avoid another craft. The tow line slacked

and the parasail crashed onto the water, severely injuring the friend using

the parasail. The cost of the friend’s medical treatment is ineligible for

coverage. |

11. Pollution Damage

There is no coverage for loss caused by any conceivable incident involving pollution unless such damage is the result of a sudden accident.

|

Example: Lorna has to spend nearly $5,000 to have the damage from a spill

remediated. Scenario 1: Lorna was caught dumping a nearly full, ten-gallon can of cleaning solvent overboard. The loss is ineligible for coverage. Scenario 2: Lorna ran aground, rupturing her boat’s fuel

tank. The loss is eligible for coverage. |

12. Professional Services

The boatowner policy’s liability portion is not a form of errors and omission or professional liability coverage. Therefore, losses that have any connection with performing professional services are ineligible for the policy’s protection.

Note: Persons who, because of their training or occupation, owe others a professional level of duty, should arrange for specific coverage.

13. Racing or Speed Tests

"Bodily injury" or "property damage" resulting from the use of a covered boat, non-owned boat, or equipment in, or in the practice or the preparation for, racing, speed, pulling or pushing, demolition, or stunt activities or contests is not covered. The exclusion does not make a distinction between organized and spur-of-the-moment activity. The policy states that races are events in which an insured is involved with a competition against another party or against the clock. However, competitions involving sailboats are still covered for related losses.

|

Example: Illustration of Race Course |

|

14. War or Military Action

"Bodily injury" or "property damage" caused by the following war or warlike situations is not covered:

- Undeclared war

- Civil war

- Insurrection

- Rebellion

- Revolution

- Warlike act by a military force or military personnel

- Destruction, seizure, or use of property for a military purpose, or

- Discharge of a nuclear weapon (even if accidental).

ADDITIONAL EXCLUSIONS

THAT APPLY ONLY TO COVERAGE X – PERSONAL LIABILITY

Note: Some of the exclusions assure that more than one coverage part can’t be used to respond to the same loss.

1. Contractual Liability

Liability assumed under a contract or an agreement, except for a written agreement involving dock rental or boat storage, is excluded from coverage.

2. Employees

"Bodily injury" to a person who is in the course of working for an insured is excluded. The exclusion extends to relatives of an employee who may be injured as a consequence of injuries to the employee. The exclusion also prevents coverage for situations involving employer liability to either the worker or a third party.

3. Insureds

The boatowner policy denies coverage for injury suffered by any person falling under its definition of insured. Besides the person named in the declarations insureds are those persons are related to the named person, but only if they are part of that person’s household. The definition (and exclusion) also extends to persons younger than 21 who are cared for by the named person or by related, household residents.

|

Example: Harold’s

household includes his sister Mara and 16-year-old Jenna. Mara is Jenna’s

guardian. While Jenna and Harold are not related, if she were injured while

occupying or using Harold’s boat, she would be ineligible for reimbursement

for her injury as she is considered an insured. |

4. Property Owned, Occupied, Used, or Rented

Under the liability portion of the policy, no coverage applies to damage to property that is owned or controlled by any insured. This exclusion makes an exception, allowing property damage to launch ramps, docks and/or boat storage house that are rented to an insured (as long as the insured is the ONLY renter).

5. Workers Compensation

This policy will not respond to bodily injury when it either IS or is legally required to be handled by workers compensations coverage, the provisions of the U.S. Longshoremen’s and Harbor Worker’s Compensation Act, non-occupational disability policy or occupation disease coverage.

ADDITIONAL EXCLUSIONS

THAT APPLY ONLY TO COVERAGE Y – MEDICAL PAYMENTS

1. Trespassers

This policy will not respond to bodily injury that involves a person occupying covered property (including a non-owned boat) without authorization.

2. Workers Compensation

This policy will not respond to bodily injury when it either IS or is legally required to be handled by workers compensations coverage, the provisions of the U.S. Longshoremen’s and Harbor Worker’s Compensation Act, non-occupational disability policy or occupation disease coverage.

UNINSURED BOATER COVERAGE

COVERAGE Z – UNINSURED

BOATER

1. Coverage

The boatowner policy’s applicable uninsured boater limit is the maximum amount of coverage available for handling bodily injury suffered by an insured from involvement with an uninsured boat. An insured must qualify for recovering payment from an owner or operator of an uninsured boat. The injury must arise out the ownership, use, or maintenance of an uninsured boat.

|

|

Example: Hank

was injured while waterskiing behind his friend Jessica’s motorboat. He lost

his balance and the grip on the tow rope when going across the violent wake

left by two racing boaters. Hank suffered a concussion and a severely

wrenched back, requiring thousands of dollars in treatment and rehab. Neither

Hank nor Jessica could identify or locate the racing boatowners. Initially,

Jessica’s boat insurer denied the claim, arguing that, since there was no

contact, it was not the same as a “hit and run” incident. The insurer later

settled and paid for most of Hank’s expenses when Jessica threatened to sue

for breach of contract |

Note: While uninsured boater coverage is very similar to uninsured motorist protection, it is neither standardized nor is it required under various state laws. Therefore, how it may apply to a given loss will depend upon the policy’s wording and loss circumstances.

2. Non-Binding Judgment

This provision relieves the insurance company from an obligation to pay a judgment or settlement from an uninsured boater made without the insurer’s written agreement.

Note: This is a safeguard for the insurer who, in all likelihood, will want to investigate any instance where a lack of insurance is alleged in a given loss.

3. Uninsured Boat Is

This coverage contains its own definition of uninsured boat. It refers to a boat that is not protected by insurance (or liability bond) that physically injures an insured. A boat is also uninsured when coverage is in place but the insurer either denied coverage or become insolvent. An uninsured boat may also be unidentifiable such as in a hit and run situation.

4. Uninsured Boat Is Not

The policy states that a boat does not qualify as “uninsured” when it is covered under the policyowner’s Coverage X part and coverage is denied by the insurance company. It is also not uninsured if the craft is owned by the government (either unit or agency).

Related Article: Uninsured/Underinsured Watercraft Considerations

EXCLUSIONS THAT APPLY TO COVERAGE Z – UNINSURED BOATER

This section of the Boatowner policy lists sources of loss that ARE NOT covered.

1. Business Pursuits

No coverage is available for injury to an insured when the loss surrounds the use of a boat (owned or non-owned) in business activity which includes being paid to carry persons or goods, or chartering (or renting) out the property to others.

|

Example: Richtowne H.S. holds its senior prom on a privately-owned

island. Many students from nearby Plainburg H.S. would like to attend.

Markie, an enterprising Plainburg student who has operated his dad’s boat

many times, borrows a neighbor’s uninsured boat and charges his fellow

students $20 a person to ferry them out to island to crash the party. During

the last trip back from the island, Markie slips and severely cuts his hands

and arms. Markie‘s father’s boatowners uninsured motorist protection would not

respond to Markie’s injury even though it occurred on an uninsured boat. |

|

2. Criminal Acts

Involvement in illegal activities that end up injuring a person is excluded, including losses related to transporting illegal cargo or passengers.

3. Owned or Rented Property

Under the uninsured boater portion of the policy, no coverage applies to injury suffered by any party that qualifies under the policy’s definition of “insured” when the injury involves a boat that is either rented by or is regularly accessible to an insured. Coverage is also barred for a boat owned by any insured but which is not listed as covered property under the boatowner policy’s liability coverage part.

Note: The rationale for this exclusion is that, if an insured has exposure from a given boat, then he or she must make arrangements to specifically insure that property. This is a method for insurance companies to make sure they are properly paid for the risks they agree to write.

4. Racing or Speed Tests

"Bodily injury" resulting from the use of a covered boat, non-owned boat, or equipment in, or in the practice or the preparation for, racing, speed, pulling or pushing, demolition, or stunt activities or contests. The exclusion does not make a distinction between organized and spur-of-the-moment activity. The policy states that races are events in which an insured is involved with a competition against another party or against the clock. However, competitions involving sailboats are still covered for related losses.

5. Settled Claims

This policy will not pay ANY party when an agreement for payment has, without the insurer’s authorization, been made with another party that may be legally responsible for causing bodily injury.

6. Trespassers

This policy will not respond to bodily injury that involves a person occupying covered property (including a non-owned boat) without authorization.

ARBITRATION – COVERAGE Z – UNINSURED BOATER

1. This section allows either the insured or the insurance company to request (in writing) a dispute regarding coverage or coverage amount to be resolved via arbitration. However, the process is triggered ONLY if the non-requesting party agrees to participate.

Related Article: Alternative Dispute Resolution – Mediation

2. Both parties have 20 days from the date of written notice to select their own arbitrator and to notify the other party. The chosen arbitrators then select a third arbitrator. A local court may choose the third member of the team if the selection isn’t made within 30 days.

Note: The deadlines are a little unclear since the requesting party would actually, first, have to receive notice that the other party has agreed to participate and there’s no reference to when acceptance has to be made.

3. The arbitration site is the county of residence of the insured. However, if both parties agree, a different site may be used. The local laws of the applicable site apply to the arbitration process.

4. The policy’s applicable limit is the maximum that may be awarded, but any award decision is non-binding.

Note: As the provision is non-binding (neither party is obligated to accept the decision), it is more likely to be used however, it may result in being a tool to help frame a court dispute; rather than resolve an issue.

5. Each party has to pay for its selected arbitrator and share equally in the expense of the third arbitrator.

WHAT MUST BE DONE IN CASE OF LOSS

This section of the policy discusses a very important part of the policy, the promise of the insurer, under described circumstances, to pay for a loss (including defending a lawsuit). Because the policy is a contract, both the insurer AND the insured have responsibilities. The manner in which a loss or possible loss is handled by an insured is critical to making sure that the policy properly responds to a loss.

1. Duties – All Coverages

a. Notice

1) Notice to Insurer

When a loss occurs, the insured is obligated to quickly share information about the occurrence with the insurance company ("us" or "our" agent).

The company providing coverage has a right to ask that the notification be in writing.

While speed in reporting a loss is important, quick notification is useless if it doesn’t include enough information with which to make decisions. Therefore, the notification has some content requirements. Specifically, the notice should include all of the following:

· The name of the "insured"

· The policy number

· The time, place, and loss details

· The names and addresses of all known potential claimants and witnesses.

2) Notice to Others

If a boat-related loss (either owned or non-owned), involves a person disappearing from a boat, death, theft, vandalism or other criminal activity, the named insured is obligated to notify the U.S. Coast Guard, policy or local authorities.

b. Cooperation

"Insureds" must cooperate with the applicable insurance company in performing all acts required by this policy.

The policy requires that an insured work with, rather than against, the insurer in order to investigate and process a possible claim.

Related Court Case: Breach of "Cooperation" Condition by Insureds Held To Warrant Insurer's Denial of Burglary Claim

c. Volunteer Payments

When an "insured" makes payments, pays or offers rewards, or assumes obligations or other costs it does so at that insured’s own cost. However, this limitation does not apply when such costs are allowed by this policy.

Note: The policy allows an insured some leeway to make payments to respond to emergencies or to help mitigate problems. However, an insured has to take great care in making payments that fall outside of the parameters permitted by the company. EVEN when an insured agrees to make payments out of his or her own pocket, he or she needs to be aware of the ramifications of such payments. Certain actions may be interpreted as an admission of guilt or responsibility for a loss, when that interpretation may be wrong.

2. Other Duties - Property Coverages

a. Proof of Loss

If the insurance company requests it, the “insured” is required to provide the insurer with a signed, sworn proof of loss. The proof of loss must be submitted within 60 days from the date of the insurer’s request and it must show the following:

· The time, place, and the details of the loss

· The (insurable) interest of the "insured" and the (insurable) interest of all others, such as mortgagees and lienholders, in the property. If a party cannot demonstrate an insurable interest in the damaged property, the insurer is not obligated to make payment to an insured.

· Other policies that may cover the loss, since other policies may have to also provide coverage for an eligible loss

· Changes in title or use

· Detailed repair estimates

· The quantity, description, cost, amount of loss, and actual cash value of the personal property involved in the loss. Copies of all bills, receipts, and related documents must be given by the insured to the insurer in order to confirm all information.

b. Repairs

The Boatowner policy places a premium on preserving property. An "insured" is required to extend a good faith effort to protect covered property at and after an insured loss to avoid additional loss. The company agrees to reimburse the insured’s reasonable costs incurred for necessary repairs or emergency measures performed solely to protect covered property from further damage. However, the preservation effort must involve covered property that is endangered by a covered peril or a covered peril which has already damaged covered property. The "insured" must keep an accurate record of such costs.

|

Example: The hull of Noel’s sailboat was punctured

while docked during a summer squall. The hole occurred at the waterline. Noel

sent his insurer a supplemental, $600 claim for his loss. When his insurer

questioned the additional amount, Noel explained that the expenses were for transporting,

inflating and installing a set of pontoons and anchors to keep the boat from

taking on additional water and sinking. The insurer paid the amount along

with the repairs. |

|

However, the insurer will not pay for such repairs or emergency measures performed on property which has not been damaged by a peril insured against. This action does not increase the "limit."

c. Examination Under Oath

“Insureds” must, as often as the insurance company reasonably requests, agree to be questioned under oath regarding items connected to a loss or claim. If more than one person is questioned, the questioning may be done in isolation from other persons involved with a loss or claim.

This duty helps to protect a company against attempts to conspire to file false claims. On the positive side, it may also assist in getting the most details concerning a valid loss.

d. Show Damaged Property

Any damaged property involved in a claim must be displayed for the insurer. Further, the insured must give access to the property to the insurance company, including granting permission to take samples of damaged property for inspection, testing, and analysis as often as the insurer (reasonably) requests.

|

Example: Scenario 1: Meddlesum Marine Insurance Co. asks the insureds, the Jaysons, to exhibit a damaged outboard motor three times during their claim investigation. This would be reasonable. |

|

|

Scenario 2: Meddlesum Marine Insurance Co. asks the insureds, the Jaysons, to exhibit a damaged outboard motor 13 times during their claim investigation. This would NOT be reasonable and the Jaysons

could refuse further access. |

e. Records and Documents

The insured must show records and permit copies to be made of them as often as the insurance company reasonably requests. Records include tax returns and bank records of all canceled checks that relate to the value, loss, and costs and similar information.

f. Assisting With Enforcing Right of Recovery

The insured must help the insurer with any effort it exercises in order to take action against another party in order to be reimbursed because that party has some responsibility for causing a loss.

3. Other Duties—Coverage X - Personal Liability and Coverage Z

Uninsured Boater

a. Notices Demands and Legal Papers

Claims that involve personal liability insurance can have very high stakes since they may expose a company to tens or even hundreds of thousands of dollars in payments. In case of an "occurrence" that might result in a claim, the "insured" is required to provide the insurer with copies of all related papers such as notices, demands, and legal papers.

b. Assistance with Claims and Suits

When the insurer asks, insureds have the obligation to help with a claim or lawsuit in the following ways:

· Helping to settle a claim

· Participate in activities related to conduct suits, such as attending trials and hearings

· Helping the insurer’s effort to recover payment all parties who may be liable to an "insured" for the injury or damage

· Helping to round up and present evidence

· Assisting with making sure that witnesses appear and participate in suit activity

4. Other Duties – Coverage Y - Medical Payments

When there is a loss, the injured person or his or her representative must provide the insurance company with written proof of a claim as soon as it is practical. Note that, if required, the statement may have to be made under oath. The insurer must also receive permission to get copies of medical records.

The insurance company has a right to investigate the medical claim. Therefore, the injured person must submit to medical exams. These exams will be conducts by doctors chosen by the insurance company and be conducted as often as the company requests. However, the requests must be reasonable.

HOW MUCH WE PAY

In this portion of the policy, the company’s obligation to provide insurance protection to an insured is described.

1. Property Coverages

a. Actual Cash Value Terms

Actual cash value includes a deduction for depreciation. The boatowner policy settles loss to all covered property on an actual cash value basis. The smallest of the following amounts is used in applying the "terms" under the insurance company’s “limit”:

1) The actual amount spent to repair or replace the property with materials of like kind and quality. This must involve following the manufacturers specifications and repair practices that are considered acceptable.

2) The actual cash value of the property at the time of loss

3) The applicable policy limits

b. Deductible

The deductible is applicable to all property coverages provided by the boatowner policy except the form’s Emergency Service protection. A single deductible applies to a given loss, except when more than one boat is involved. In such instances, the deductible applies to each boat, including its motor and, if applicable, its trailer.

The deductible that appears on the policy declarations page applies to losses caused by all covered perils. The insurance company providing coverage will pay the part of the loss that exceeds the deductible.

c. Loss to Parts

If there is a loss to a part of a covered item that is made up of several parts when it is complete, the insurer is only obligated to pay for the value of the lost or damaged part or the cost to repair or replace it.

This provision is meant to control the insurer’s exposure. In this case, the insurer makes it clear that it is not automatically obligated to treat a partial loss as, for all intents, a total loss. Of course, the loss circumstances and the type of property involved have a great deal to say about the values involved and what is considered to be fair.

|

Example:

Bessie’s custom painted skiff has a matching outboard motor. Bessie’s friend,

a professional artist, used a special metallic and lacquered mixture paint to

do the work, creating a mural that spread from the motor to the boat’s hull.

One day, a violent wind caused swells that pitched Bessie’s boat backwards,

smashing her motor against a pier. Her insurer pays for a brand new outboard

motor that was the same model and brand that was destroyed. Bessie’s claim

included the expense to have the custom paint job done again, but insurer

denies that portion of the claim. |

|

d. Insurable Interest

This provision of the boatowner policy limits the insurance company’s payment obligation to the actual insurable interest of the named insured, even if the covered property has multiple insurable interests.

2. Liability Coverages

a. Coverage X—Personal Liability

The "limit" shown on the "declarations" for this coverage is the absolute maximum the insurer is obligated to pay for a given, eligible "occurrence." This maximum (applying to BI and/or PD) is not affected by any of the following:

· Number of persons insured under this policy

· Total parties who sustain injury or damage

· Number of claims made or suits brought

· Number of boats involved in a loss

· Number of boats, motors, trailers or premiums that appear in the policy’s declarations page

· Number of policy periods related to a given loss

|

Example: Jules

and Krista Hungleson's graduation party for their

youngest daughter takes a bad turn. They hold it on their houseboat and the

boat is taken on a cruise along the shore. While distracted watching their

daughter react to gifts, Jules allows the boat to drift too close to the

shore and it strikes the river bed. The hull is not breached, but the severe

jerking sends most of the guests sprawling and three were tossed overboard.

Every injured person files a suit against the Hunglesons

in the following manner |

|

||

|

Plaintiff |

Damages Sought |

Defendant (named in

suit) |

|

|

Guest A |

$24,000 |

Jules |

|

|

Guest B |

$33,500 |

Krista |

|

|

Guest C |

$16,800 |

Jules & Krista |

|

|

Guest D |

$29,000 |

Jules |

|

|

Guest E |

$36,500 |

Jules |

|

|

Total |

$139,800 |

Jules (3), Krista (1), Both (1) |

|

|

The fact that there are five separate suits and that Jules and Krista have been sued both singly and as a couple has no effect on the policy limit of $100,000 being the most available to respond. The policy treats the event as one loss. One area that will be substantially affected is the amount provided for defense costs because the carrier could, conceivably, have to defend all six suits. |

|||

b. Coverage Y—Medical Payments

1) Limit - The "limit" shown on the "declarations" under this coverage is a per person limit. It is the most available to pay for all medical expenses due to "bodily injury" for each person in a single accident. If a person has more than one accident in a policy term, that person would be eligible for additional payments.

2) Reduction of Amounts Payable - If, for a given loss, the boatowner policy has made payment (for medical expenses) under either the sections for Personal Liability or Uninsured Boater, the amount payable under Medical Payments for those particular expenses is reduced by that amount.

3) No Admission of Liability - The payment of a claim under Coverage Y does not imply liability under Coverage X. In other words, the policy may cover the medical expenses of an injured person without giving up the right to investigate and decide upon the merits of any related liability claim.

|

|

Example: Helen is sued by her friend who claims that

she was injured due to Helen improperly storing equipment on her boat and

that she tripped and broke her hip while a guest on an excursion. At the time

of the injury, Helen’s friend was transported from the marina to an emergency

room. Helen paid for the transportation and for the emergency room visit and

was later reimbursed by her insurance company under Coverage Y. When Helen

submits the paperwork on her friend’s lawsuit, her insurer explains that they

will fully investigate the matter. Later, after interviewing Helen’s friend,

they discover that she was hurt while trying to win a bet with another guest

that she could balance herself on one leg. The insurer pays Helen’s friend

another $3,500 to handle some additional medical expenses but informs the

friend they will pay nothing more because Helen was not negligent. The

lawsuit is then dropped. |

3. Coverage Z—Uninsured

Boater

a. Limit - The boatowner policy includes a limit on the declarations page for uninsured boater coverage (a defined term). This amount is the absolute maximum available for payout on a single, eligible loss and the amount is unaffected by any of the following:

· Number of persons insured under this policy

· Total parties who sustain injury or damage

· Number of claims made or suits brought

· Number of boats involved in a loss

· Number of boats, motors, trailers or premiums that appear in the policy’s declarations page

· Number of policy periods related to a given loss

Related Court Case: Only Single Watercraft Limit Applied To Entire Loss

b. Reduction of Amounts Payable – Payments that are eligible to be made under the boatowner policy’s Uninsured Boater provisions are affected by other sources of payment. Under any given loss, an obligation under Uninsured Boater will be reduced if payment has been made (or if coverage is available) under the Personal Liability section. Further, reductions may also be made when payments:

· For BI that occurs from parties who are legally responsible for the injuries

· For BI that is due to laws and regulations such as workers compensation, U.S. Longshore and Harbor Workers Compensation Act, non-occupational disability or occupational disease

Any payment made to an insured under Coverage Z will reduce payments available to that insured under Coverages X and Y.

4. Insurance Under More Than One Coverage

If more than one part of the boatowner policy’s parts qualifies for paying for a loss, this provision limits protection to the actual amount of the loss. This condition assures that a person is not allowed to benefit from a technicality that, otherwise, would result in duplicate payment.

5. Insurance Under More Than One Policy

Depending upon the source of coverage that is available (in addition to this policy), the policy may respond to the loss on either a proportional or an excess basis.

When the other source of coverage is issued to the named insured by the same insurer that provides the boat coverage, payment works similarly to the “other part of policy provision,” with only the highest amount of protection available applies (no duplicate payments). This policy is primary if that the other coverage is an excess policy.

When the other coverage is provided by another carrier, how this policy reacts is based on the type of coverage. The insurance company providing property coverage under this form is only obligated to pay its share of the loss. This policy’s share is based upon the portion of coverage it provides in relationship to the total amount of coverage available from all sources of coverage which apply to the loss. Under personal liability, medical payment and uninsured boater coverage this policy responds on an excess basis unless the other source of coverage is specifically issued as an excess layer of coverage in which case the boatowner policy responds on a primary basis.

|

Example: Jana’s

flatboat is insured by HayboyWaterz Boaters Insurance. However, Jana also has

an umbrella policy from Beshuransave P&C. That policy shows the boatowner

policy as an underlying coverage. When Jana is sued for severely injuring

several persons in a boat she collided with, the HayboyWaterz policy will

handle everything until and unless its coverage is exhausted. |

|

PAYMENT OF LOSS OR CLAIM

1. Your Property

a. When We Pay

Losses are adjusted between the named insured (including resident spouse) and the insurance company. The insurance company is obligated to pay an insured loss within 60 days after receiving an acceptable proof of loss and coming to a written agreement on amount of the loss.

If there is a dispute between the insured and the insurer, the insurer has to make payment within 60 days after the filing of an appraisal award.

b. Our Options

The insurance company (our) has some flexibility in paying for an eligible loss. The settlement may be paid in money or the insurer may choose to rebuild, repair, or replace the property. The insurance company is obligated to give the insured notice of its intent within 30 days after the insurance company receives an acceptable proof of loss.

c. We Take Property

The insurance company has a right to take all or part of the damaged property at the agreed or appraised value. If the insurance company pays for or replaces property, it then belongs to them.

|

Example: During

the off-season, Handerby’s boat is kept in dry dock

at Acme Marina. Handerby’s boat is heavily damaged

when a fire is caused by lacquer fumes from a ceiling renovation job ignite. Handerby is paid $36,000 for the loss of his boat. His

insurer later reduces their payment to $32,000 when they discover that Handerby was paid $4,000 in salvage for his boat’s

remains. |

|

This last option is another way to make certain that an insured is indemnified for, rather than enriched by, a loss. Insurers also salvage property as one way to help recoup their loss payments.

d. Payment Made to You

Unless there is a loss payee (or some other party that is legally entitled) payment is made to the named insured.

2. Coverage X – Personal Liability

This part of the How Much We Pay for

Loss or Claim section notifies the policyholder that a third party that secures

a right to payment because of a judgment or a valid written agreement may

recover for their injuries or damage to their property. The recovery,

naturally, is limited to the boatowner policy’s applicable limit. In other

words, the insurance limit shown on the declarations is available to respond to

a court judgment or a written settlement.

3. Coverage Y – Medical Payments

This part of the How Much We Pay for Loss or Claim section notifies the policyholder that expenses for eligible medical treatment may be paid to the party that is injured, that party’s representative or, directly, to the medical service provider.

|

Example: Josh’s

college friend broke his leg while on a fishing trip. His X-rays and

treatment costs totaled $672. Josh’s friend sent the bill he received from

Bassville Medikare to Josh and Josh turned it into his insurer. The insurance

company sent payment directly to Bassville Medikare. |

|

ADDITIONAL EXCLUSIONS AND LIMITATIONS

1. Fines Penalties or Tax Liens

The boatowner policy restricts its payment obligation by stating that no coverage applies to amounts that represent fines, penalties or tax liens that are due to breaking a law or are assessments made by the government.

2. Seaworthiness Warranty

This provision specifically states a couple of expectations that the insurance company demand to be met by the policyholder. First, the boatowner is to have property that is in safe condition and can be used to navigate bodies of water. Second, no coverage applies when a loss is related to an insured who fails to keep the insured property in navigable condition.

|

Example: Nate turned

in a loss after a storm sent his moored boat against a dock, severely

cracking part of the hull. After an investigation, the insurer denied the

claim. They discovered that the boat had not been properly stored during the

off-season and the hull had been weakened by dry rot. |

OTHER POLICY CONDITIONS

CONDITIONS APPLICABLE TO ALL COVERAGES

1. Assignment

This policy may not be assigned without the written consent of the insurance company providing coverage.

Note: Insurance policies are underwritten based on the named insured. Assigning a policy to a different named insured requires a total re-underwriting of the account.

2. Change, Modification, or Waiver of Policy Terms

Only the company has the option of waiving or changing this policy’s "terms" and it must be in writing. When the insurance company requests an appraisal or examination under oath, it does not waive policy "terms."

3. Conformity with Statute

"Terms" in conflict with the laws of the state in which the premises shown on the "declarations" is located, are changed to conform to such laws.

4. Death

If the named insured dies, the protection provided by the insurance policy will pass to one of the following:

· The legal representative of the insured

· Any other persons having proper but temporary custody of the covered property but this applies only until the legal representative is appointed.

The policy’s extended coverage only applies to loss related to use of the covered property and only during the time that a representative is performing duties on behalf of the deceased insured.

This coverage extension ends at the policy term’s expiration.

5. Liberalization

If the insurance company providing coverage creates a revision of the edition of this boatowner coverage that both broadens coverage and does NOT create a premium charge, that broader coverage applies to the policy effective the date that the change is adopted in the insured’s state (rather than when the policy renews for another policy term). However, the automatic extension of coverage does NOT apply to changes due to the insurance company adopting a new edition of the boatowner policy.

6. Misrepresentation, Concealment, or Fraud

Any intentional concealment or misrepresentation on the part of any insured can void the policy for ALL insureds. Lying or hiding a material fact concerning the reason for securing the insurance, the property or person(s) covered, the insured’s interest in the covered property or similar actions can result in the dissolution of the agreement. This may occur either before or after any loss.

|

Example: Erin

turned in a claim for her sailboat that was lost during a storm. She didn’t

expect any problem when she turned in a claim for her loss. She was surprised

several weeks later when her claim was denied. The insurance company’s letter

stated that her insurance policy was being voided. Their investigation

concluded that the boat was nearly 15 years older than reported on her

insurance application. |

Simply put, the company should be able to rely on the statements made by an insured in making its decision to insure a person or property. If the statements are seriously in error, the insurance contract has no right to exist and the company has no obligation to honor it.

7. Recoveries

There are instances when the insurer pays for a loss and then the property is recovered. Similarly, after the insurer’s payment, damages are received from those responsible for the loss. When this happens, the insured and the insurer are obligated to inform each other and then to proceed with one of the following options:

· The insured may keep the property but must then return any claim payments (or some agreed upon amount) to the insurer

· If, because of a deductible or other reason, the subsequent amount received is LESS than the actual loss amount, the recovery may be distributed between the insured and the insurance company. Each party’s share would be based on their financial interest in the loss.

Under this provision, costs paid by the insurer and/or the insured to recover the items are paid before an action is selected and such payments are taken into consideration.

What is important about recoveries is that they are resolved in a manner that is fair to the insurer and the insured. One party should not significantly benefit from the recovery of property or money if it comes at the expense of the other party.

8. Subrogation

When an insurer pays damages, it may ask the insured to give up his or her right to legally recover damages from another party (which has responsibility for causing a loss to the insured). This act of seeking payment from a party responsible for a loss is called subrogation. This right is very valuable to an insurer. In fact, if an insured weakens this right to recover payment after a loss has occurred, the insurer may no longer be obligated to pay for the loss.

The insured may waive all rights to recover before a loss occurs—but this waiver must be in writing. Signing this waiver BEFORE a loss does not affect coverage under the policy. However, if the insurance company pays for a loss and the insured later receives payment from another party, the insured must reimburse the company providing coverage as outlined above in “Recoveries.”

Note: This policy condition does not apply to Coverage Y – Medical Payments.

9. Territory

The AAIS boatowner program includes a large area where coverage is in effect. Protection applies:

- On the Great Lakes

- In the United States and Canada (including up to 100 miles from either country’s coasts)

Note: The 100 miles is limited to 10 miles for “personal watercraft” (as defined in the policy).

CONDITIONS THAT APPLY ONLY TO PROPERTY COVERAGES

1. Abandonment of Property

The insured may not abandon property to the insurer without the insurer’s permission.

Of course, if the insurer agrees to accept the damaged property, the act is NOT abandonment.

2. Appraisal

If the insurer and the insured do not agree over the value of the covered property or the amount of the loss, each party has 20 days (after receiving a written request from the other party) to select an appraiser. The two appraisers will select an umpire.

If they do not agree on an umpire (once selected, the party’s appraisers have 15 days to choose one), either the insured or the insurer may ask a judge of a court of record of the state where the appraisal is pending to make the selection. ALL disputed amounts are resolved (as far as determination) when written agreement of any two of these three persons is reached.

Each party will pay its appraiser and the two parties will share the cost of the umpire and related expenses equally.

Note: Each initial appraiser will make their own determination and, if they don’t agree, will share these amounts with the umpire to get an opinion which will set a final determination.

IMPORTANT: This provision does NOT state whether the appraisal decision is binding on any party.

3. Inspections

This provision allows the insurance company the option of inspecting boating property and such work may be done by either insurer personnel or other parties hired or used by the insurer.

|

Example: Barbara just received a new policy from Blu-Cees Insurance Company; via the Newbee Agency. Since the agent was recently appointed by the insurer, it is evaluating the new business being sent in to the company: Scenario 1: Blu-Cees sends one of its claims adjusters to take photos of Barbara’s boat. Scenario 2: Blu-Cees hires a retired, former insurance agent to take photos of Barbara’s boat. Both instances are valid exercises of this inspection

provision. |

Inspections, when performed, are intended to get firsthand information on whether the boating property insured under the policy is safe, free of health hazards (pollutants, toxins, bacteria, fungi, etc.), is capable of being safely operated on water, and complies with applicable codes, laws and regulations.

When inspections are made, they are only for use by the applicable insurer. The information is not intended to certify or create warranties about the boating property to the insured or to other parties.

4. No Benefit to Bailee

This policy is not intended to provide protection for the direct or indirect benefit to parties who are paid to assume custody of the covered property.

In other words, such persons or organizations should secure their own insurance instead of “piggybacking” onto an “insured’s” coverage.

5. Suit Against Us

The insured is not permitted to file suit against the insurer without, first, complying with all of the policy’s “terms.” Further, any lawsuit must be filed within two years after the loss.

Note: In some states this time frame may conflict with state law. If so, the suit must be brought within whatever time frame is allowed by that state.

CONDITIONS THAT APPLY ONLY TO LIABILITY COVERAGES

1. Bankruptcy of an Insured

Bankruptcy or insolvency of an "insured" does not change the insurance company’s obligation to fulfill the provision of the boatowner policy. Naturally, things would change IF the insured lost his or her insurable interest in the property protected by the policy.

|

Example: Hanna

has fallen on hard times. She loses her business and, to meet other bills,

she sells her boat to Tina. While showing off her new boat, Tina hits a pier

and hurts several persons who were fishing there. Several injured persons sue

Tina. Tina asks Hanna to file a claim since she hadn’t arranged for her own

boat insurance. Hanna’s insurance company denies the claim since the sale was

completed before the loss. |

2. Suit Against Us

The insured is not permitted to file suit against the insurer without, first, complying with all of the policy’s “terms.” Also, no legal action can move forward until the amount of the "insured's" liability has been determined by either of the following:

· A final judgment against the "insured" as a result of a trial

· A written agreement between the "insured," the claimant, and the insurer.

Note: No person has a right under this policy to join the insurance company or to speak for the insurance company in actions related to determine the amount of an "insured’s" liability.

Menu (click here to expand or to collapse)

Menu (click here to expand or to collapse)